Investing in warehouse solar is no longer about environmental goodwill; it’s a calculated financial strategy to de-risk operations and lock in predictable energy costs for the long term.

- The primary financial gain often comes from mitigating volatile demand charges, not just reducing kWh consumption.

- Pairing solar with the correct battery storage (Lithium-Ion vs. Flow) transforms an energy system into an asset that ensures business continuity during outages.

Recommendation: Conduct a detailed load profile analysis to accurately model demand charge savings and determine the optimal system size for maximum ROI.

For facility managers and asset owners, the line item for energy is often seen as a volatile and uncontrollable operating expense. The traditional approach of simply paying the utility bill month after month leaves businesses exposed to price shocks, grid instability, and punitive demand charges. While rooftop solar has been discussed for years, it was often framed in the context of environmental benefits or complicated tax incentives, making a clear financial case difficult to ascertain.

The conversation, however, has fundamentally shifted. Advanced energy storage systems, sophisticated financial modeling, and increasing grid fragility have changed the equation. The key to understanding modern commercial solar is to stop viewing it as a simple cost-reduction measure and start analyzing it as a strategic financial instrument. But what does this mean in practice? It means moving beyond a simplistic payback calculation and assessing solar’s role in mitigating operational risk, creating predictable cash flows, and ultimately, hardening your facility’s financial and physical resilience.

This analysis will dissect the key financial and operational levers that make solar a compelling investment for warehouse assets. We will move past the superficial arguments and provide a mathematical and investment-focused framework for evaluating a commercial solar project, from initial yield estimation to advanced battery deployment strategies.

To provide a clear and structured financial perspective, this guide examines the core components of a successful commercial solar strategy. We will break down the risks of grid dependency, the methods for calculating potential returns, the critical choices in technology, and the operational strategies that maximize your investment.

Summary: Commercial Solar ROI: A Financial Breakdown for Warehouse Assets

- Why Reliance on Grid Power Is Becoming a Strategic Risk for Factories?

- How to Estimate the Solar Yield of Your Commercial Roof in 10 Minutes?

- Lithium-Ion vs. Flow Batteries: Which Storage Fits Industrial Power Spikes?

- The Grid Connection Mistake That Delays Solar Projects by 6 Months

- How to Shift Energy-Intensive Processes to Peak Solar Production Hours?

- How to Size a Battery System for Critical Warehouse Loads

- Why Legacy Machinery Is Costing More in Energy Than a Modern Retrofit?

- Are Standalone Battery Systems a Viable Investment for Warehouses?

Why Reliance on Grid Power Is Becoming a Strategic Risk for Factories?

Dependency on the public grid is no longer just a line item on an expense report; it’s a significant, unhedged strategic risk. For industrial facilities and warehouses, this risk manifests in two primary forms: financial volatility and operational disruption. Utility rates are not static; they are subject to geopolitical energy price fluctuations, regulatory changes, and the rising costs of maintaining an aging infrastructure. This unpredictability makes long-term financial planning difficult, as a core operational cost remains outside of managerial control. A sudden spike in energy prices can directly erode profit margins.

Beyond price volatility, the risk of grid failure is increasing. Extreme weather events, cyberattacks, and infrastructure strain can lead to brownouts or blackouts, halting production, jeopardizing climate-controlled inventory, and causing significant financial losses. Every hour of downtime has a quantifiable cost. On-site energy generation, therefore, becomes a form of business interruption insurance that, unlike a traditional policy, also generates a positive return on investment through cost savings. By generating your own power, you create a natural hedge against these market and physical risks.

The scale of this strategy is being proven by major industry players. A prime example of this strategic shift is seen in the logistics sector, which operates on thin margins where cost control is paramount.

Case Study: Prologis’s Strategic Solar Deployment

Prologis, a global leader in logistics real estate, has embraced this strategy by installing over 400 MW of solar capacity across its portfolio. This massive deployment is not merely a green initiative; it’s a core business strategy to provide predictable energy costs for its tenants and increase the value of its assets. This capacity generates enough renewable energy to offset more than 200,000 metric tons of CO2 annually, demonstrating that large-scale financial and environmental goals can be fully aligned.

This proactive approach transforms a warehouse roof from a passive structural element into an active, revenue-generating, and risk-mitigating asset. The decision to invest in solar is increasingly a question not of “if,” but of “when and how.”

How to Estimate the Solar Yield of Your Commercial Roof in 10 Minutes?

Before engaging in detailed engineering proposals, a facility manager can perform a high-level financial viability assessment. This “back-of-the-envelope” calculation aims to determine if a solar project is worth a deeper investigation. The process focuses on three key variables: usable space, potential system size, and estimated financial return. For large commercial properties, the numbers quickly become compelling.

First, estimate your usable roof space. A typical 200,000 sq ft warehouse roof, after accounting for obstructions like HVAC units and walkways, may have around 180,000 sq ft of viable area for solar panels. Second, translate this area into a potential system size. With modern high-efficiency panels, this space can often accommodate a 1-2 Megawatt (MW) system. Third, estimate the annual energy generation. This is done by multiplying the system size (in kW) by a local production ratio (kWh/kWp/year), which is based on your region’s average solar irradiance. Online tools can provide a reliable estimate for this ratio.

Finally, apply a preliminary financial lens. The most crucial factor is not just the energy produced, but how much of it you can consume directly during operating hours (the “self-consumption ratio”). For warehouses operating primarily during daylight, this ratio is often very high. By offsetting peak-rate electricity purchases, a 1-2 MW system can generate annual savings in the range of $250,000 to $500,000. For many facilities, this leads to a remarkably short payback period. In fact, financial models often show that many warehouse facilities achieve full return on investment in well under five years, making it one of the most attractive capital improvement projects available.

Lithium-Ion vs. Flow Batteries: Which Storage Fits Industrial Power Spikes?

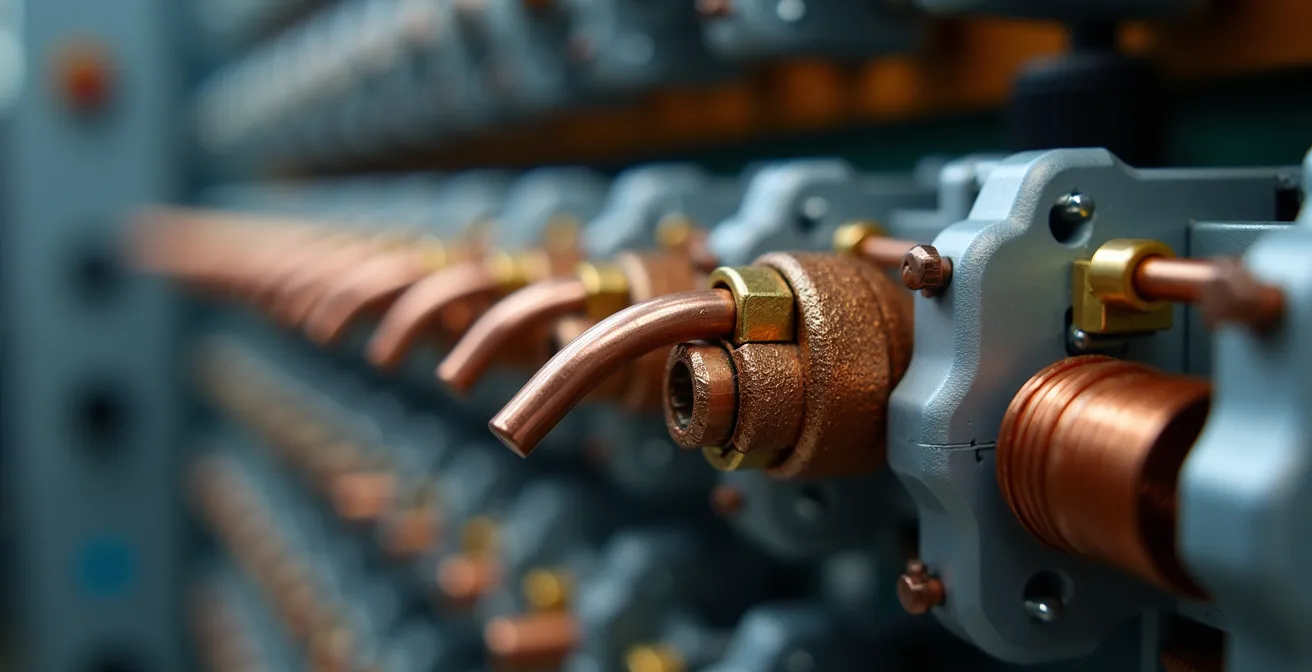

Once solar generation is established, the next level of financial optimization comes from energy storage. A battery system transforms a solar installation from a simple energy-saving device into a dynamic asset capable of managing peak demand and ensuring operational continuity. However, not all battery technologies are suited for the rigorous demands of an industrial environment. The choice between the two leading chemistries, Lithium-Ion and Vanadium Flow, is a critical investment decision based on your facility’s specific load profile.

Industrial operations are often characterized by significant “power spikes”—large, intermittent loads from machinery start-ups, conveyors, or refrigeration compressors. These spikes are what drive expensive demand charges from utilities. Lithium-Ion batteries excel in power density, meaning they can discharge a large amount of energy very quickly to neutralize these spikes. They are compact and highly efficient. However, their cycle life can be limited, and performance can degrade with deep, frequent cycling.

Vanadium Flow batteries, conversely, offer a different value proposition. Their key advantage is a vastly superior cycle life and durability; they can be fully charged and discharged thousands of times with minimal degradation. They are ideal for applications requiring long-duration energy shifting (e.g., storing several hours of solar energy for overnight use). Their energy capacity is decoupled from their power rating, offering more design flexibility. The trade-off is lower energy and power density, meaning they require more physical space for the same capacity.

The decision hinges on a detailed analysis of your operational needs. Is your primary goal to shave short, high-power peaks, or to shift large blocks of energy across many hours? The following table, based on recent analysis, provides a quantitative comparison to guide this critical decision.

This comparison, drawn from an in-depth analysis of energy storage systems, highlights the financial and performance trade-offs that must be weighed when designing a system for an industrial setting.

| Metric | Lithium-Ion | Flow Batteries |

|---|---|---|

| Energy Density | 200 Wh/kg | 100 Wh/kg |

| Power Density | 500 W/kg | 300 W/kg |

| Efficiency | 90% | 80% |

| Cycle Life | 500 cycles | 1000 cycles |

| Material Cost | $200/kWh | $150/kWh |

| Installation Cost | $5,000 | $8,000 |

| Maintenance Cost | $200 | $300 |

The Grid Connection Mistake That Delays Solar Projects by 6 Months

In the financial modeling of a commercial solar project, timelines are money. A delay of six months means six months of lost savings and a postponed return on investment. While facility managers often focus on hardware selection and installation logistics, the most common and costly delay comes from a single, frequently underestimated source: the utility interconnection process. Assuming this is a simple administrative step is a critical mistake.

Utilities have stringent requirements for connecting a significant generation asset to their grid. This involves detailed engineering reviews, impact studies to assess the effect on local grid stability, and a lengthy permitting process. For large systems, especially those over 1 MW, this is not a rubber-stamp approval. The utility must ensure your system’s inverters and control systems meet their technical standards and will not compromise grid safety or power quality for other customers. This review and approval cycle can easily take 7-9 months for large-scale installations if not managed proactively from day one.

The mistake is treating the utility application as a final step after system design. Instead, it must be an integral part of the initial project assessment. Engaging with the utility early, understanding their specific technical requirements and application queue, and submitting a professionally prepared application package are paramount. Any errors or omissions in the initial submission can send you to the back of the line, triggering months of delays. Therefore, a robust project plan allocates significant resources and expertise to navigating this bureaucratic but essential phase.

Action Plan: De-risking Your Solar Project Timeline

- Initial Assessment: Begin with a comprehensive energy audit, a structural evaluation of the roof, and a thorough review of your facility’s existing electrical infrastructure and utility interconnection point.

- Utility Pre-Application: Engage the utility’s interconnection department before finalizing the design. Discuss your proposed system size and understand their specific impact study requirements and current backlog.

- Parallel Processing: Do not wait for one step to finish before starting the next. Initiate the permitting and utility application processes while the detailed engineering drawings and structural analyses are being completed.

- Expert Submission: Hire an installation partner with a proven track record of successful utility interconnections in your specific territory. Their expertise in preparing a flawless application is invaluable.

- Contingency Planning: Build a 1-2 month buffer into your financial model and project timeline specifically for potential utility-side delays. This turns an unforeseen risk into a managed variable.

By treating the grid connection as a critical path item from the outset, you can protect your project’s timeline and financial viability.

How to Shift Energy-Intensive Processes to Peak Solar Production Hours?

A solar installation’s ROI is not solely dependent on the total kilowatt-hours it produces; it is heavily influenced by when that energy is used. The most valuable solar energy is that which is consumed on-site (“self-consumed”) as it is generated, as this directly displaces the purchase of the most expensive electricity from the grid. This strategy, known as load shifting, is a powerful lever for maximizing financial returns. The good news for warehouses is that their operational profile is often naturally aligned with solar production, as most operate during daylight hours.

The core principle is to identify energy-intensive but non-time-critical processes and reschedule them to occur between mid-morning and mid-afternoon, when solar output is at its peak. This requires a detailed analysis of your facility’s energy consumption patterns—a process known as load profiling. By mapping your energy use on an hourly basis, you can pinpoint opportunities for optimization. Common candidates for load shifting include battery charging for forklifts and other material handling equipment, running large pumping systems, or executing maintenance tasks that require significant power.

A particularly effective strategy involves HVAC systems, which are a major source of energy consumption. This is a clear example of turning operational processes into financial tools.

Load Management Case Study: HVAC Pre-Cooling

Climate control can account for 40-60% of a warehouse’s total electricity usage. Instead of running HVAC systems on a static thermostat setting throughout the day, a pre-cooling strategy uses abundant and “free” solar energy during peak production hours (e.g., 11 AM to 3 PM) to cool the facility a few degrees below the target temperature. The building’s thermal mass then retains this coolness, allowing the HVAC systems to be scaled back or turned off during the late afternoon when solar production wanes and grid electricity rates may be higher. This is especially lucrative for cold storage facilities, where refrigeration can be 15-25% of total operating costs, making solar-powered pre-cooling a high-impact strategy to reduce peak demand charges.

This intelligent management of energy consumption transforms your facility from a passive consumer into an active participant in its own energy economy, a concept known as energy cost arbitrage.

How to Size a Battery System for Critical Warehouse Loads

While demand charge mitigation is a primary financial driver for battery storage, its second function is even more critical for many operations: ensuring business continuity during a grid outage. For a warehouse, this isn’t about keeping the lights on; it’s about protecting high-value assets and processes. The key is to identify the “critical loads” that absolutely must remain operational and size a battery system specifically to support them.

The first step in this calculation is a critical load audit. This involves moving beyond the total facility consumption and itemizing the specific circuits that power essential systems. For a typical warehouse, these might include:

- Server Racks and IT Infrastructure: To maintain logistics, inventory, and management systems.

- Emergency Lighting and Security Systems: For safety and asset protection.

- Refrigeration Units: For cold storage facilities where product loss can be catastrophic.

- Automated Picking Systems: To prevent logistical gridlock upon power restoration.

Once these loads are identified, you must calculate their combined power draw (in kW) and the total energy they would consume (in kWh) over a desired backup duration (e.g., 4 hours). For example, if your critical loads total 50 kW and you require 4 hours of backup, you would need a battery system with at least 200 kWh of usable capacity and a 50 kW power output. This targeted approach is far more cost-effective than attempting to back up the entire facility. The financial return comes not only from the savings during normal operation but also from the avoidance of catastrophic losses during an outage.

This dual-purpose investment—providing both daily savings and emergency backup—presents a powerful financial case. For instance, a system sized for critical loads can still participate in demand charge management on a daily basis. As a financial benchmark, modeling shows that a 500 kWh battery reducing 200 kW of peak demand saves a facility between $48,000 and $60,000 annually, a figure that makes the resilience aspect almost a free bonus.

Why Legacy Machinery Is Costing More in Energy Than a Modern Retrofit?

The energy consumption of a warehouse is not just a function of its lighting and HVAC; the machinery operating within its walls is a massive, and often inefficient, contributor. Legacy equipment—older conveyor systems, compressors, and manufacturing tools—can silently drain profits through poor energy efficiency. Investing in a modern energy system like solar without addressing these underlying inefficiencies is a missed opportunity. The cost of running this old machinery often exceeds the price of a modern retrofit when viewed over a multi-year horizon.

There are several technical reasons for this. First, older AC induction motors often suffer from a poor power factor, meaning they draw more current from the grid than they actually use for productive work. Utilities often penalize facilities with a low power factor by adding a surcharge to their bills. Second, this machinery frequently has a high inrush current upon start-up, creating significant power spikes that are the primary driver of expensive demand charges. A single piece of equipment starting up can set a new peak for the entire month’s bill.

Modern equipment and retrofits, particularly with the integration of Variable Frequency Drives (VFDs), solve these problems. VFDs allow motors to ramp up their speed slowly, eliminating the high inrush current. They also enable motors to run at the precise speed required for the task, rather than at a constant full speed, drastically reducing overall kWh consumption. The energy savings from a VFD retrofit can often pay for the investment in 2-3 years, while simultaneously making the entire facility’s load profile more compatible with a solar and storage system. The scale of energy consumed by the U.S. warehouse sector is immense; analysis from Environment America Center shows that U.S. warehouses could collectively power nearly 19.4 million homes if their roof space were utilized for solar, underscoring the magnitude of the energy footprint that needs to be managed efficiently.

Key Takeaways

- Solar ROI is accelerated by targeting demand charge mitigation, not just kWh savings. This is the primary financial lever in commercial energy projects.

- Matching battery technology (Li-ion for power density, Flow for cycle life) to your specific industrial load profile is critical for performance and long-term financial return.

- The biggest non-financial return is operational resilience—insulating your facility from grid instability and price shocks, which can be valued as a form of business interruption insurance.

Are Standalone Battery Systems a Viable Investment for Warehouses?

While solar and storage are a powerful combination, a compelling financial case can often be made for a standalone battery storage system, even without on-site solar generation. This strategy is particularly potent for facilities in energy markets with high demand charges and significant differences between on-peak and off-peak electricity rates. The investment becomes an exercise in pure energy cost arbitrage.

The operational principle is simple: the battery system is programmed to charge from the grid during overnight, off-peak hours when electricity is cheapest. It then discharges that stored energy during the afternoon, on-peak hours to power the facility. This displaces the purchase of the most expensive grid power, generating savings from the price differential. More importantly, the battery is used to actively “shave” the facility’s highest consumption peaks. By discharging rapidly to counter spikes in demand from machinery, the system can dramatically lower the monthly peak demand (kW) that the utility uses to calculate a large portion of the bill. It is not uncommon for these systems to achieve a 60-80% reduction in demand charges.

The choice of technology is again crucial in this context. While Lithium-Ion is a contender, flow batteries present a particularly strong argument for this high-cycling, daily arbitrage application. Their extreme durability and long cycle life are perfectly suited for a system that will be charged and discharged every single day. As one prominent manufacturer, Invinity Energy Systems, noted in a performance study, the levelized cost of energy can be highly competitive. According to their analysis published by the American Chemical Society, when paired with wind power, their batteries can deliver power at 25–30% less cost than comparable lithium-ion systems over the asset’s lifetime, underscoring the importance of total cost of ownership calculations.

Ultimately, a standalone battery is a sophisticated financial tool. It allows a facility to actively manage its exposure to volatile energy pricing and punitive demand structures, turning a passive operating expense into a actively managed and optimized cost center.

To translate these principles into a concrete financial projection, the next logical step is to commission a professional energy audit and load profile analysis for your facility.